Standing on a Step Before the ITC Decline

In 2005, Congress passed the Energy Policy Act. Part of the purpose of the bill was to incentivize energy efficiency, new technologies, and sustainability. One of its initiatives included an Investment Tax Credit (ITC) that gave a 30% tax credit for installed solar systems. It was initially set to be a two-year incentive for 2006-7 but was extended in 2006 for an additional year.

In 2008, when the economy took a nosedive, the ITC was extended for an additional eight years to help spur renewable deployment and in doing so, create thousands of clean energy jobs. During its fourteen-year history, the ITC has proven to be one of the most successful drivers of solar deployment in the country, helping the solar industry grow more than 10,000% and infusing billions of dollars into the U.S. economy. In 2015, the credit was extended with sunset provisions established.

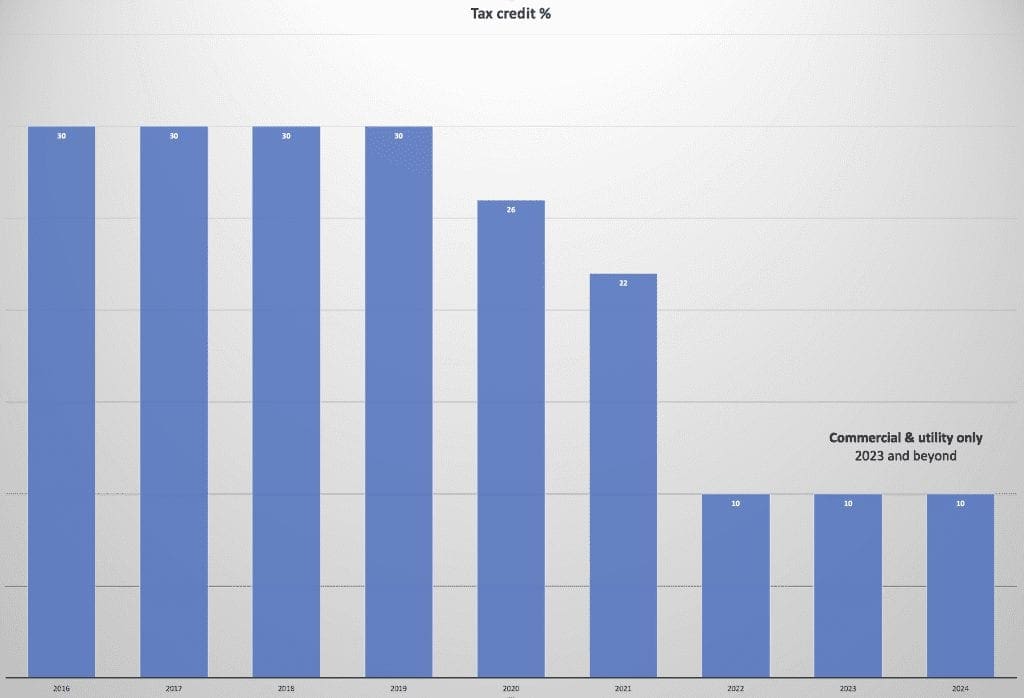

This year, 2020, is the first year of the sunset stepdown. While last year still allowed for the 2019 30% credit, this year has a 26% tax credit. Here is the step down in graphic form:

Can a new Congress extend the ITC once again? Perhaps, but it may be a while before the federal government gets to it with other urgent issues to address, like a deadly lung virus that has killed 180,000 Americans at the time of this posting.

The material point, though, is that as it stands the federal tax credit is the best it’s going to be for the foreseeable future. And a 26% credit claimed against the tax liability of a commercial solar energy system is still a very good incentive. So if you’re considering solar for your property, there’s literally no time like the present in order to capitalize on this opportunity to save money while producing clean energy.